Introduction to Banking Options

The financial services landscape has experienced significant transformations over the years, particularly with the emergence of advanced technology in banking. Traditional banking, characterized by brick-and-mortar institutions, has been the cornerstone of financial services for decades. These banks offer a variety of services, including savings accounts, loans, and investment options, often emphasizing personal relationships and face-to-face interactions. Customers have traditionally relied on bank tellers and personal bankers for guidance through financial decisions, fostering trust and familiarity.

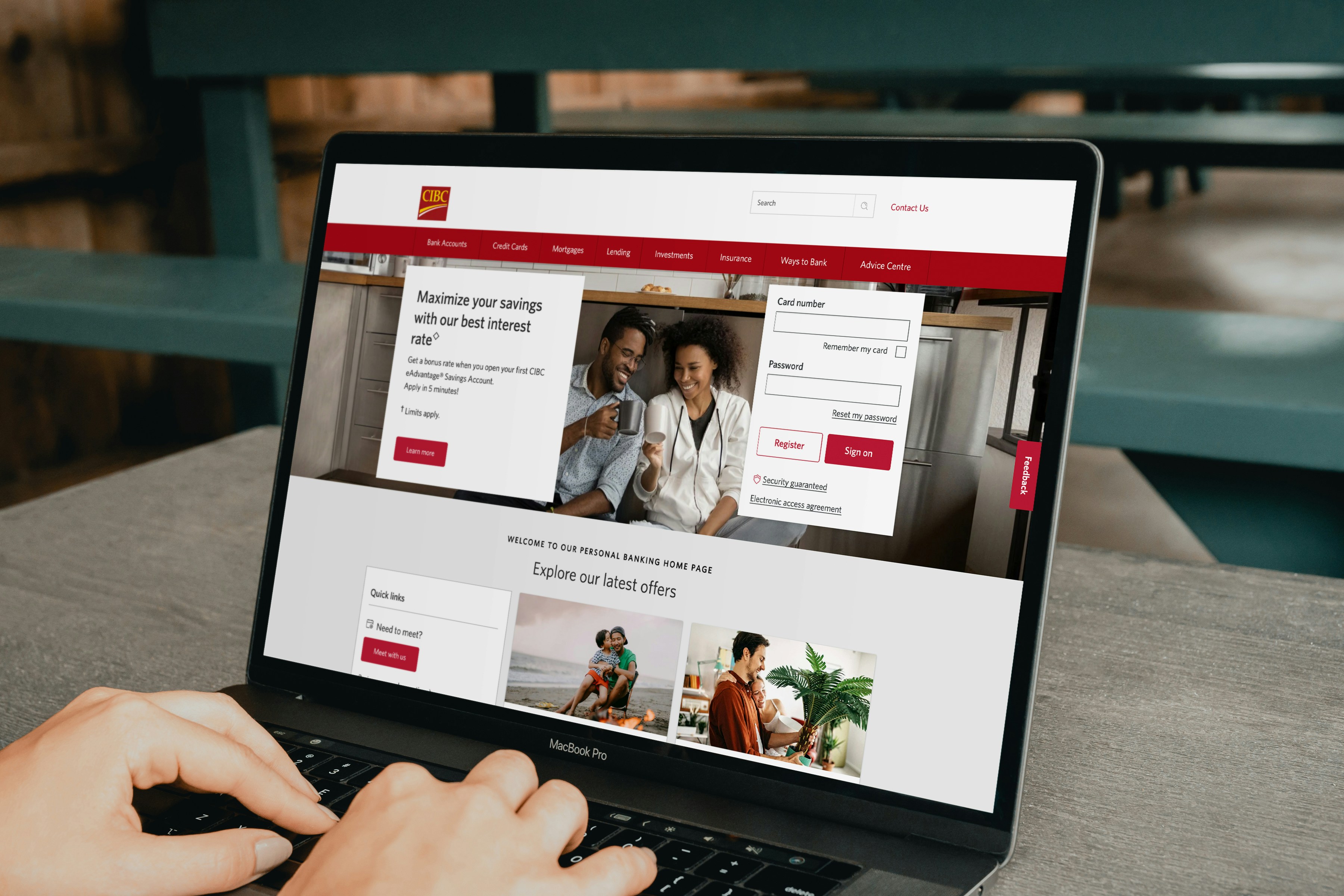

In contrast, the rise of AI-powered banking solutions represents a modern shift towards convenience and efficiency. These innovative platforms leverage artificial intelligence and machine learning to provide users with personalized banking experiences. AI-powered banking solutions are designed to enhance customer engagement by utilizing data analytics, enabling users to manage their finances through intuitive mobile applications. This approach caters to the growing demand for instant access to financial services, enabling individuals to perform transactions, access account information, and receive financial advice with unprecedented ease and speed.

The influence of technology in this sector is not merely a trend but a pivotal shift reshaping consumer expectations and experiences. As AI continues to develop, its applications within banking are expected to expand, offering more sophisticated tools such as predictive analytics, chatbots for customer service, and automated financial planning services. Consequently, the choice between traditional and AI-driven banking solutions has become increasingly relevant, as consumers weigh the benefits of personalized service against the efficiency and convenience provided by technology. By understanding these two distinct approaches, individuals can make informed decisions based on their financial needs and personal preferences.

Understanding Traditional Banking

Traditional banking has long been the cornerstone of the financial services industry, characterized by established systems and practices that have evolved over decades. At the heart of this model are brick-and-mortar branches where customers can engage in face-to-face interactions with bank personnel. These physical locations serve as vital hubs for a range of services, from opening accounts and processing loans to providing financial advice. The personal touch afforded by human agents is a significant aspect of traditional banking, as it often fosters trust and assurance among customers. Individuals can seek clarification on complex financial matters, a feature that some find reassuring compared to automated banking alternatives.

Furthermore, traditional banks uphold regulated practices that have been developed over time, contributing to their reliability. These institutions operate under strict regulatory frameworks that protect consumer deposits and ensure financial stability. The human judgment involved in decision-making processes is particularly noteworthy, as trained professionals weigh the nuances of each customer’s situation, offering tailored advice that considers both immediate needs and long-term financial goals.

However, traditional banking is not without its limitations. In a modern, technology-driven era, these institutions face challenges such as high operating costs associated with maintaining numerous branches and personnel. Additionally, the need for longer processing times compared to automated systems can frustrate customers accustomed to instant gratification. Competitive pressures from fintech companies that leverage technology for greater efficiency further exacerbate these issues, leading to a shift in consumer expectations. As customers increasingly gravitate toward convenience and speed, traditional banks are compelled to adapt or risk becoming obsolete in a landscape that is progressively embracing digital solutions.

Exploring AI-Powered Banking

The banking sector has undergone a significant transformation with the emergence of artificial intelligence (AI) technologies. AI-powered banking refers to the integration of advanced algorithms and machine learning capabilities into financial services, enabling banks to enhance customer engagement, improve operational efficiency, and provide personalized experiences. These innovations are reshaping how consumers interact with their finances and access banking services.

One of the most widely recognized applications of AI in banking is the deployment of chatbots. These virtual assistants utilize natural language processing to facilitate real-time communication with customers, providing immediate responses to queries regarding account balances, transaction history, or loan applications. Chatbots are accessible 24/7, significantly reducing wait times and improving service delivery. Their ability to learn from interactions ensures they become increasingly effective in understanding and addressing customer needs.

Moreover, AI-powered banking platforms offer automated financial advice, assisting users in making informed decisions about investments, savings, and budgeting. By analyzing vast datasets, these systems can identify spending patterns, predict future financial behaviors, and recommend tailored solutions to enhance financial health. Personalized services are another key feature of AI technologies, with many banks leveraging machine learning to assess individual preferences and design customized product offerings.

The efficiency offered by AI in banking is remarkable. Routine tasks such as transaction monitoring and fraud detection can be automated, allowing human resources to focus on more complex issues. Furthermore, AI systems can adapt and evolve based on market trends and customer feedback, ensuring banks remain responsive to changing consumer demands. As AI continues to integrate into banking services, it presents a compelling case for the future of finance, fostering an environment that values convenience and continuous improvement.

Comparative Analysis: Convenience and Accessibility

In the realm of financial services, the convenience and accessibility of banking solutions are pivotal factors influencing consumer preferences. Traditional banking, characterized by physical branches and in-person interactions, often adheres to set hours of operation, typically from 9 AM to 5 PM on weekdays. Such rigid schedules can present obstacles for customers who require assistance outside of these hours, particularly during emergencies. In contrast, AI-powered banking solutions significantly enhance accessibility, providing 24/7 availability. Customers can manage their finances and seek support at any time, reflecting the demands of the modern consumer who often requires flexible financial services in an increasingly fast-paced world.

The ability of AI-powered banking solutions to serve clients in remote areas also stands out as a significant advantage. Traditional banks have limitations when it comes to branching locations, which can exclude underserved populations. On the other hand, digital banks empowered by AI can extend their services to remote regions, allowing individuals who may have been previously unbanked or underbanked to access essential financial tools. This expanded reach is instrumental in promoting financial inclusivity and equity.

Additionally, mobile and online banking platforms represent a substantial evolution in user experience and convenience. With advances in technology, customers can perform a multitude of transactions from the comfort of their own homes or while on the go. These platforms often incorporate user-friendly interfaces, enabling individuals with varying levels of tech proficiency to engage with their finances seamlessly. The integration of chatbots and virtual assistants in AI-driven solutions further enhances ease of use, allowing customers to quickly resolve queries without needing to visit a physical branch.

Overall, the comparative analysis of convenience and accessibility reveals that while traditional banking has established itself as a foundational service, the innovative capabilities of AI-powered solutions are transforming the landscape, making financial services more readily available to a wider audience.

Security Measures: Trust in Banking

When considering the security aspects of traditional banking versus AI-powered banking, it is essential to examine their respective security protocols, customer perceptions of safety, and the methods used to handle fraud prevention and data protection. Traditional banks have long established their security frameworks, relying on a combination of physical safeguards, regulatory compliance, and technology. This includes the use of encryption for online transactions, strong authentication methods, and various measures to ensure data privacy. In contrast, AI-powered banking relies heavily on advanced algorithms and machine learning to enhance security features. By analyzing large volumes of transaction data, AI systems can identify unusual patterns that may indicate fraudulent activity more quickly and accurately than traditional methods. Additionally, AI technologies are continually evolving, making it possible to stay ahead of potential security threats. However, this reliance on technology can raise concerns regarding data breaches, as high-profile hacks have demonstrated that even the most sophisticated systems can be vulnerable.Customer perceptions of safety also differ between the two approaches. Many individuals have grown accustomed to the established security measures in traditional banks and may feel more comfortable with familiar systems. Trust in long-standing institutions influences user confidence in traditional banking. On the other hand, AI-powered banking appeals to a tech-savvy demographic that values convenience and seamless user experience. These customers may be more receptive to innovative security measures, provided they are clearly communicated and demonstrate effectiveness.Both traditional and AI-powered banking must continue to prioritize and enhance their security measures as evolving threats emerge. Measures such as frequent security audits, transparency in data handling, and user education surrounding security practices are crucial for maintaining consumer trust. Establishing a culture of continuous improvement and vigilance in security will ultimately determine the success and acceptance of both banking methodologies in an increasingly digital landscape.

Customer Experience and Personalization

Customer experience is a pivotal factor in the financial services industry, shaping the relationship between banks and their clients. Traditional banking, often characterized by face-to-face interactions, provides a personalized touch that many customers value. In this framework, bank professionals leverage their interpersonal skills to understand clients’ needs and preferences, creating customized solutions tailored to individual circumstances. This human element fosters trust and loyalty, as customers feel their unique financial situations are appreciated and addressed by attentive representatives.

On the other hand, AI-powered banking services redefine the concept of personalization through advanced data analytics. These systems analyze vast amounts of customer data, allowing banks to predict needs and preferences at an unprecedented scale. By utilizing algorithms, AI can deliver personalized recommendations, notifications, and products suited to a customer’s financial behavior. This technological approach enhances efficiency and accessibility, making it incredibly convenient for clients seeking immediate assistance or guidance without the constraints of traditional banking hours or geographic limitations.

Moreover, AI tools can learn and adapt over time, further refining their interactions and recommendations based on ongoing customer behavior. This dynamic capability ensures that users receive increasingly relevant and tailored experiences whenever they engage with their financial platforms. Despite the lack of human interaction, many customers appreciate the efficiency and speed of AI-driven services, especially in an era where convenience is paramount.

While traditional banking emphasizes the importance of personal relationships, AI-powered services offer unmatched scalability and instantaneous responses. The future of customer experience in banking may not entail choosing one approach over the other, but rather finding a harmonious balance that incorporates the strengths of both traditional methods and innovative AI solutions.

Cost Efficiency: Banking Fees and Charges

The banking landscape has evolved significantly over the years, particularly with the advent of technology-driven solutions. Traditional banks often impose a variety of fees, including monthly maintenance fees, ATM withdrawal charges, and overdraft penalties. These fees can accumulate quickly, making banking expensive for customers who use these institutions regularly.

On the other hand, AI-powered banking solutions typically operate with a different cost structure. Without the extensive physical infrastructure that traditional banks maintain—such as branches and their associated operational costs—AI-driven platforms can often minimize or eliminate common fees. These digital banks frequently offer free or low-cost account maintenance, reduced withdrawal fees, and lower overdraft charges. Customers may also benefit from streamlined services that do not require in-person appointments, enabling quicker responses and improved convenience.

However, it is essential for consumers to evaluate the pricing structures of both types of banking solutions thoroughly. Traditional banks may have hidden charges that are not immediately apparent. Such hidden fees can include charges for wire transfers, foreign transactions, and even account inactivity. By contrast, AI-based banks often provide clear, upfront information about their pricing models, reducing the chances of unexpected charges.

Furthermore, AI-powered systems can leverage sophisticated algorithms to enhance efficiency in their operations, which contributes to a reduction in overhead costs. These savings can be passed on to the consumer, thereby providing a cost-effective alternative. Automated customer service, fraud detection, and transaction monitoring are some areas where AI excels, allowing for operational savings that traditional banks may struggle to achieve. Overall, when comparing cost efficiency between traditional banking and AI-driven solutions, the latter often presents a more financially attractive option for consumers.

Future Trends in Banking Technology

The landscape of banking technology is undergoing significant transformation, propelled by the dual forces of traditional banking practices and the rise of AI-powered solutions. Emerging trends suggest a gradual shift towards hybrid models that leverage the strengths of both methodologies. One notable trend is the growing emphasis on customer-centric services. As banks look to enhance customer experiences, integrating AI-driven insights with the core values of traditional banking is becoming increasingly important. This can facilitate personalized offerings, predictive analytics for customer behavior, and tailored financial advice, which are hallmarks of AI technology.

Another trend is the increasing proliferation of digital-only banks and fintech startups. These entities are disrupting traditional banking by providing seamless, user-friendly services that appeal to a tech-savvy generation. Many established banks are responding by partnering with fintech companies, thus merging agile innovation with their long-standing reputation for stability and trust. This partnership embodies a strategic maneuver to capture a diverse customer base while evolving in a rapidly changing environment.

Moreover, as regulatory landscapes evolve, both traditional and AI-driven institutions must adapt to compliance and security measures. The rising importance of data privacy is prompting banks to invest in advanced cybersecurity protocols. This transition is not merely a trend but a necessity, as customers demand assurance that their sensitive financial information is well protected.

Last but not least, the future may see an expanded range of services that integrate AI with traditional banking functions. For instance, tools that offer real-time financial insights, budgets, and investment strategies could redefine how customers interact with their financial institutions. These innovations promise greater efficiency and engagement while maintaining the trust embedded in traditional banking practices. As we look to the future, the synergy between traditional and AI-powered banking will likely shape a more versatile and accessible financial landscape.

Conclusion: Choosing the Right Option for You

The ongoing debate between traditional banking and AI-powered convenience has highlighted several compelling advantages and challenges associated with each approach. Traditional banks offer a sense of security, personal interaction, and established practices that many individuals trust. The value of face-to-face service, especially in complex scenarios such as obtaining loans or discussing financial planning, cannot be overstated. On the other hand, AI-driven banking solutions provide remarkable convenience, immediate access to services, and tailored financial insights, appealing to tech-savvy consumers looking for quick and efficient ways to manage their finances.

When determining the best banking solution for personal needs, individuals must consider their own financial habits, preferences, and requirements. For those who value direct human interaction, traditional banking may provide the reassurance needed for managing relationships with their financial institutions. This can be particularly important during sensitive financial discussions or when navigating difficult transactions.

In contrast, individuals who are comfortable with technology may find AI-powered systems to be a more suitable choice. The instant access to information, including real-time transaction updates and personalized financial advice, can significantly enhance the banking experience. Furthermore, the flexibility offered by digital platforms, such as mobile banking apps, allows users to access their accounts anytime, anywhere, thus aligning with the increasingly fast-paced lifestyle of many today.

Ultimately, the choice between traditional banking and AI-powered convenience should resonate with your unique financial profile. A reflective analysis of your day-to-day banking needs, comfort level with technology, and value placed on personal relationships with banking professionals will guide you toward a decision that best serves your financial landscape. Balancing the two options may also yield benefits, allowing you to enjoy both the stability of traditional banks and the innovations of AI-powered solutions.